Most people don’t buy a token because of governance. They buy the story, the product, and the community. That’s fine. But once you’re holding the bag, the stuff that keeps value from dumping, maintains pricing, supply discipline, and reliable access comes from how a network is governed. In other words, you don’t need governance to get in; you need it to stay in.

This is your straightforward guide to blockchain governance models—minus the jargon, plus what actually matters for token buyers and everyday Web3 users. We’ll keep it practical, compare models at a high level, and show how decisions flow into things you feel, such as cost predictability, reliability, supply, and whether incentives make sense.

What Governance Controls

Modern blockchain governance defines and enforces rules of the system—what can change, who can change it, and how changes take effect. Today, much of that authority is codified (parameters and processes in contracts or modules), with social discussion shaping proposals before execution.

Below are the core domains governance controls, with real-world examples for clarity:

a) Pricing & Fee Mechanics

- What: Base-fee formulas, burn rules, surcharges/discounts, per-method or per-unit pricing schedules.

- Why governance: Predictability, budgetability, and anti-capture (transparent rules reduce arbitrary pricing).

- Example: Ethereum’s EIP-1559 adjusts a per-block base fee algorithmically and burns it; Pocket’s Shannon uses compute-unit pricing for protocol fees with on-chain burns tied to measured work.

b) Monetary Policy & Supply Levers—issuance, burns, redemption rules, etc.

- What: Emission schedules, “mint = burn” reimbursements, buyback/burn programs, vesting/unlocks, inflation caps.

- Why governance: Aligns protocol sustainability with usage; sets clear constraints on dilution or contraction.

- Example: MakerDAO parameterizes the DSR/Stability Fee in code; Shannon links new token minting primarily to verifiable work reimbursed on-chain.

c) Access & Participation Rules

- What: Permissionless vs allowlisted roles, listing/enablement criteria, quorum/thresholds, delegation frameworks.

- Why governance: Preserves openness while managing spam and platform risk through clear, auditable criteria.

- Example: Anyone can create markets on Uniswap; Aave uses formal, scoped listings for collateral/borrowing.

d) Risk & Safety Parameters

- What: Caps/limits, circuit breakers, oracle selections, liquidation ratios, slashing/jailing conditions, timelocks.

- Why governance: Reduces systemic and operational risk with predefined, transparent responses.

- Example: Cosmos-SDK chains slash for double-signing/downtime; timelocks enforce review windows before upgrades.

e) Treasury & Incentive Allocation

- What: Grants, liquidity mining, rebates/credits, revenue routing, service-provider payments.

Why governance: Directs scarce resources toward roadmap priorities, with explicit trade-offs and reporting.

f) Upgrade & Standards Process

- What: Proposal formats, review tracks, compatibility policies, versioning/deprecation schedules.

- Why governance: Maintains safety and coherence as clients/modules evolve; reduces upgrade friction.

- Example: Pocket Network’s Shannon upgrade sets standards for the Cosmos-SDK migration, defines CU-priced burn-to-pay with mint=burn, codifies permissionless gateway + rebate tiers, and publishes versioning/deprecation and rollout timelines.

g) Representation & Roles

- What: Delegates/voters, review councils, bounded stewards/executors, emergency/security councils with narrow authority.

- Why governance: Speeds routine decisions, concentrates expertise for review, and limits emergency powers with disclosure.

Basic Blockchain governance models

Think of governance along two lines: where decisions happen and who actually flips the switch. Labels matter less than whether decisions flow into prices, supply, and access without months of gridlock.

Below are the governance models practiced today across the web3 ecosystem.

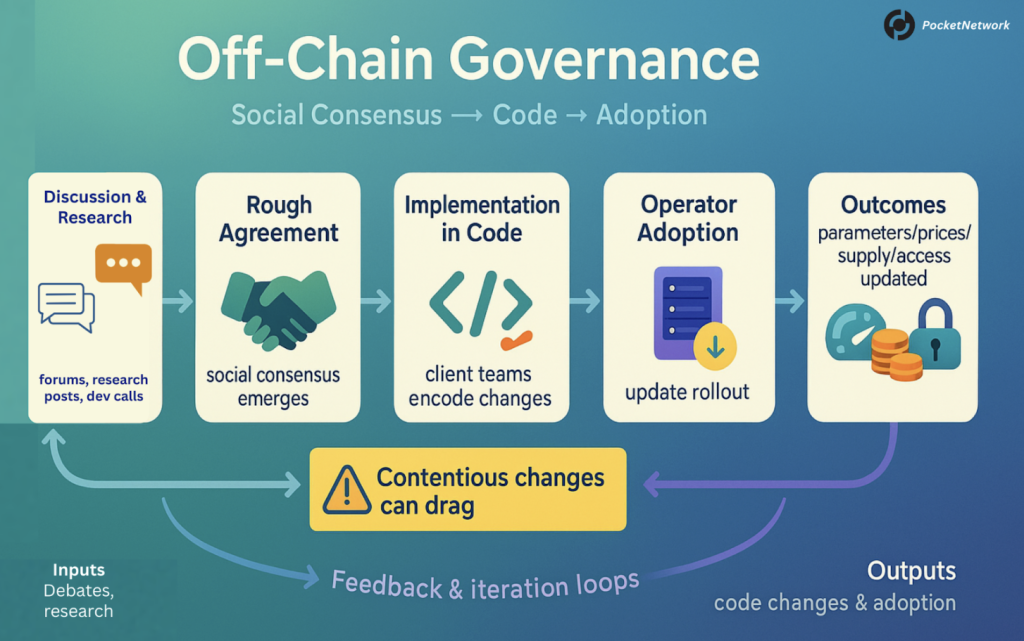

1) Off-chain (social consensus, then code)

Discussion happens in forums, research posts, and dev calls. When there’s rough agreement, client teams implement it in code and operators adopt it. It’s flexible, good for complex technical changes, and relies on social trust and credible maintainers. Tradeoff: contentious changes can drag.

An example here is the Solana’s SIMD process in which changes are proposed as Solana Improvement Documents (SIMDs), debated publicly, then put to validator votes and client implementation. This explicitly hybrid process mixes social debate with on-chain signalling. A recent SIMD proposal is SIMD-0326, which proposes a new Alpenglow Consensus Protocol for Solana to replace the PoH and TowerBFT mechanisms.

Pocket Network still has off-chain discussion for research and specs, but Shannon’s day-to-day economics are coded (CU pricing, burns), so routine adjustments don’t need a long social cycle.

Off-chain governance model diagrammatic flow

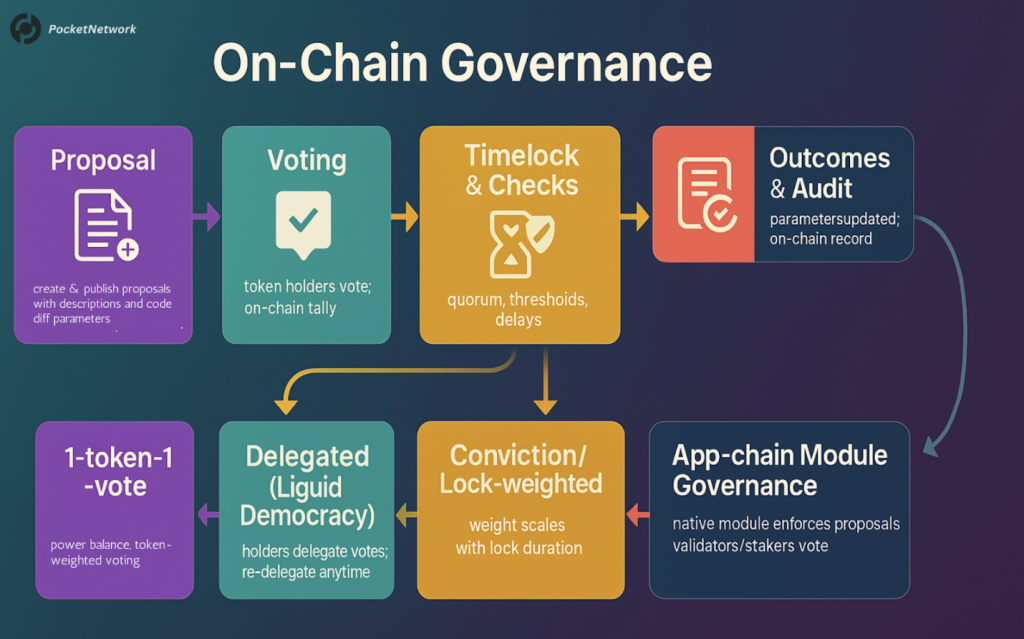

2) On-chain governance

Here, proposals are created, voted, and executed on-chain; once a proposal passes, smart contracts enforce the change (often behind a safety timelock). This is transparent and programmable, but design choices (quorum, delegation, thresholds) determine how decentralized it really is. Some tools include Tally and OpenZeppelin.

Core sub-models you’ll see in practice.

a) Token-weighted voting (1-token-1-vote): This is the default on many EVM DAOs where voting power equals token balance, usually via a votes-tracking mechanism, with proposals and execution handled by governor contracts and timelocks. It’s simple and auditable, but it can concentrate power.

b) Liquid democracy (delegated voting): Instead of voting directly, holders delegate their votes to an address, which is usually a person or a delegate platform, and can re-delegate anytime. It’s still on-chain when the delegation lives in contracts and feeds the final vote. This type of governance is standard in Compound-style systems and also appears in ecosystems like Polkadot’s OpenGov with flexible, per-track delegation.

c) Conviction/time-lock weighting: Voters lock tokens for longer to amplify their voting weight. It’s a way to privilege long-term conviction over quick flips. Curve’s veCRV model grants more voting power the longer CRV is locked (up to 4 years).

e) Full protocol governance via app-chain modules: On app-chains, governance is often a native module where staked tokenholders vote and the chain enforces results (parameters, upgrades, treasury, etc). dYdX v4 on the Cosmos SDK is a current example using the standard x/gov module.

On-chain governance model diagrammatic flow

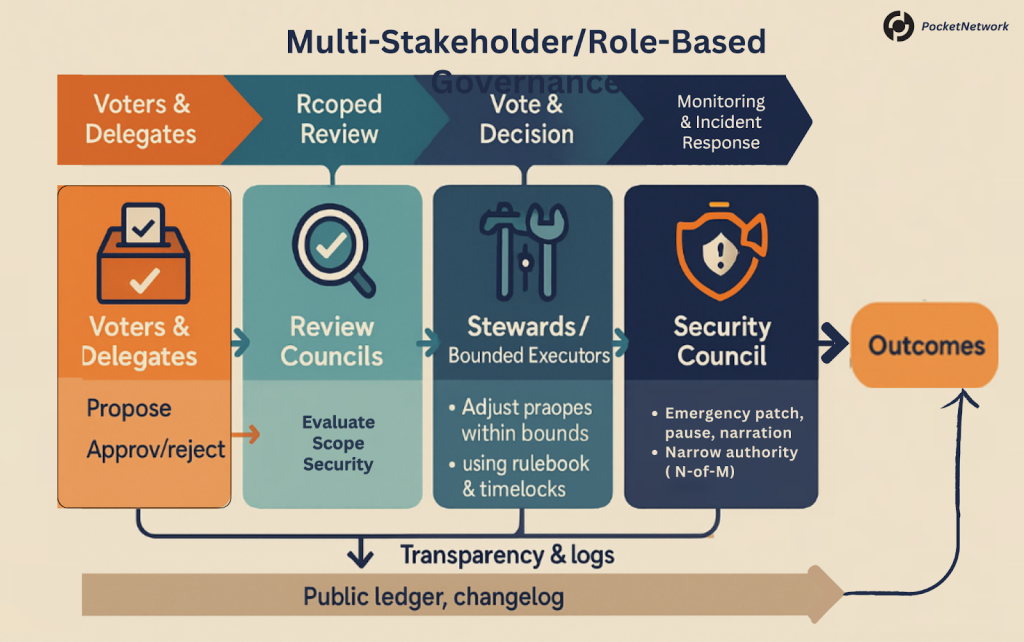

3) Multi-Stakeholder/Role-Based Governance

Multi-stakeholder or Role-Based Governance is a practical pattern for DAOs where governance authority is assigned to clearly defined roles rather than left to vague “community” buckets. Instead of listing every network participant (validators, operators, product teams), this model focuses only on who proposes, reviews, votes, executes, or intervenes. The goal is simple: faster, safer decisions with obvious accountability.

Below are the active governance participants this model uses in practice:

- Voters & delegates: The decision-making body that passes proposals (token- or identity-based). A current reference point is Optimism’s bicameral split between a Token House (token voting) and a Citizens’ House (identity/reputation voting), which balances power across two constituencies.

- Review/oversight councils: Subject-matter committees that evaluate proposals within strict scopes before execution (security, economics, upgrades). EigenLayer’s Protocol Council publicly reviews ELIPs and issues formal evaluations before upgrades.

- Bounded executors/stewards: Roles empowered to make scoped, rules-limited parameter changes between full votes (to cut governance overhead). Aave’s Risk Stewards (AGRS) adjust caps and other risk settings under DAO-defined constraints.

- Emergency guardians/security councils: Narrowly empowered groups for incident response, with hard limits and post-action transparency. Arbitrum’s Security Council requires 9-of-12 approval and must publish a transparency report after any emergency action.

Multi-Stakeholder/Role-Based Governance diagrammatic flow

How it works, end-to-end.

A proposal is drafted and socialized; the relevant review council assesses scope and risks; voters/delegates pass (or reject) it; stewards handle routine parameter tuning within DAO-set bounds; and if something breaks, a security council can perform a narrow emergency action with public disclosure.

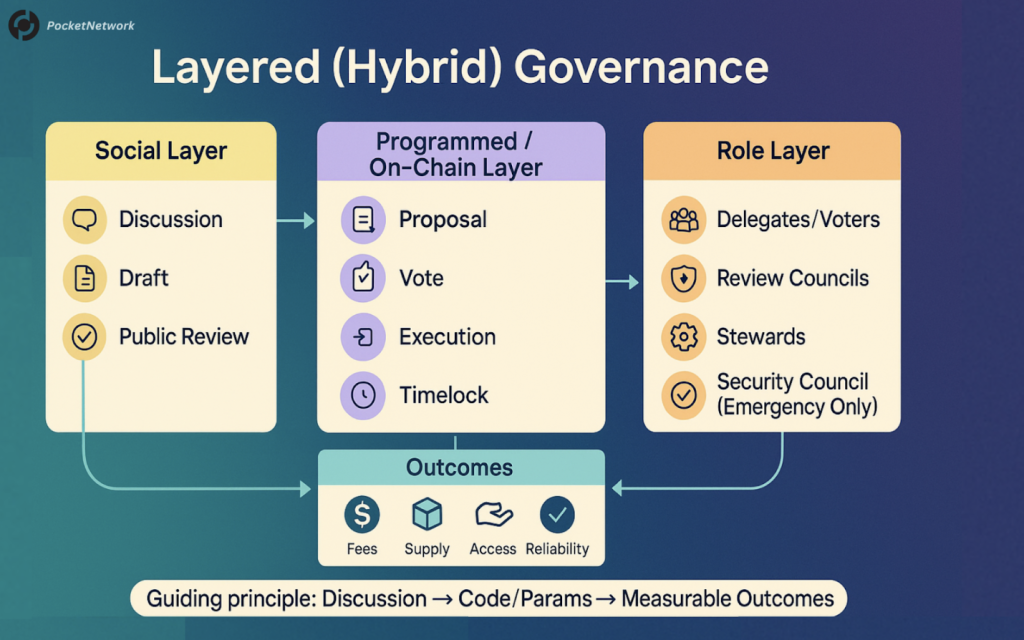

4) Layered (Hybrid) Governance Model

A layered (hybrid) model mixes governance styles—projects often use two or more of the prior models rather than one “pure” approach. In practice, that means open deliberation to shape proposals, programmed/on-chain rules to execute decisions, and clearly defined roles so operations keep moving between votes.

What matters is the feedback loop: discussion → parameter change in code → measurable outcomes (fees, supply, access, reliability).

How it shows up in the real world

- Social layer: community input becomes a well-formed proposal with public review (forums, specs, drafts).

- Programmed/on-chain layer: once approved, changes are executed predictably on parameters embedded in smart contracts. Many DAOs now pair off-chain voting with trustless on-chain execution using programmable tools (e.g., Snapshot’s oSnap/SafeSnap).

- Role layer: responsibilities are explicit, such as operators, gateways, councils, and working groups, so the network runs smoothly between governance cycles.

Layered (Hybrid) Governance Model

Table 1.0: Blockchain/DAO Governance Models at a Glance

| Governance Layer | Decision Types | Implementation Method |

| Off-chain (social → code) | Protocol changes, parameter tuning, roadmap/standards | Public forums, research posts, community calls to client releases or manual actions; Snapshot for non-binding signaling |

| On-chain: token-weighted (1 token = 1 vote) | Rates, limits, listings, emissions, upgrades, treasury moves | Governor contracts with propose/vote/queue/ execute and timelocks |

| On-chain: liquid democracy (delegation) | Same as token-weighted, routed via delegates | On-chain delegation to representatives; execution via governor contracts or chain modules |

| On-chain: conviction/time-lock weighting | Standard proposals with lock-amplified voting weight | Lock tokens to boost weight; protocol enforces lock/decay rules |

| On-chain: council / multisig (bounded powers) | Emergency actions, scoped parameter tweaks, hotfixes | Elected/appointed councils or multisigs with narrow, time-bounded authority; actions logged on-chain under DAO oversight |

| On-chain: app-chain module governance | Chain parameters, upgrades, treasury, permissions | Native modules (e.g., Cosmos x/gov) handling proposal to vote to execution |

| Multi-stakeholder / role-based | Proposal review, risk policy, parameter stewardship, and emergency response | Defined governance roles (voters/delegates, review councils, stewards, security councils) with on-chain constraints |

| Layered (Hybrid) | Social deliberation plus on-chain parameter changes; routine ops by roles | Forums/specs: on-chain execution (governors or x/gov) → role-based operations; optional Snapshot + SafeSnap/oSnap bridge |

| Pocket Network (Shannon) — two-layer hybrid | CU pricing, burn/mint coupling, rebate tiers, protocol parameters | Public forum deliberation: on-chain updates via Cosmos SDK x/gov; PATH gateways & suppliers are operational (permissionless), not governance bodies |

Pocket Network’s Governance Model

Pocket runs a two-layer hybrid model composed of off-chain deliberation in its public forum and on-chain execution on its Cosmos-SDK chain introduced with the Shannon upgrade.

Why is hybrid the right label?

- On-chain governance: With Shannon, governance parameters are managed via the Cosmos x/gov module. This module provides native proposal/vote/execute flows enforced on-chain.

- Deliberation remains public/off-chain: Pocket’s process still begins with forum discussion and spec drafting (e.g., tokenomics proposals), then moves to execution once there’s alignment. Messari’s overview of Pocket’s governance phases (discussion → off-chain signalling → implementation) captures this heritage. The Shannon upgrade tightens the last step by placing the levers on-chain.

How Pocket Network’s governance flows in practice (live examples)

Step 1: Propose & discuss (forum).

Economic/technical changes are drafted and debated publicly, e.g., the Protocol Economics Parameters for the Shannon Upgrade forum post lays out data sources, the CU pricing mechanics, and the rebate schedule for DAO review.

Step 2: Execute on-chain (governance tx).

Once agreed, parameters are changed on-chain. For example, the Governance Transaction Notice (Apr 30, 2025) documents enabling “mint = burn” accounting and related parameter adjustments—an on-chain change announced back to the community.

Step 3: Observe, report, and iterate (post-execution governance).

After parameters are executed on-chain, governance verifies behavior against the spec and decides if follow-ups are needed. Concretely:

- Measure: Track on-chain metrics (e.g., CU burns vs. mint reimbursements, relay volume, rebate accrual), service/QoS telemetry (latency, error rates), and client compatibility/version uptake.

- Document: Publish a short governance notice/changelog summarizing what changed, where it’s encoded (parameter registry/upgrade module), and any deprecation timelines.

- Compare vs. guardrails: Check observed values against pre-stated targets/limits (e.g., rebate tiers, risk caps, timelocks).

The Biggest Challenges Facing DAO Governance

While DAO mechanics have matured and have made significant progress, current governance still fails in familiar ways. Below are the most common governance failure modes.

- Low turnout to easy capture

Most DAOs still struggle to reach quorum; a handful of delegates or funds can swing outcomes. Recent research and forum threads call out persistent delegate concentration and inactive voters, which makes “decentralized” votes look centralized in practice.

- Whales, coalitions, and vote markets

Token-weighted systems privilege large holders and make pay-for-votes a rational strategy. Bribery platforms, e.g., Votium in the veCRV ecosystem, openly auction incentives to direct gauge votes—efficient, but also a vector for plutocratic capture.

- Borrowed voting power and governance grabs

If voting power can be rented quickly, an attacker can pass a malicious proposal before anyone reacts. Beanstalk was drained after an attacker flash-borrowed voting weight and executed proposals without an execution delay; Tornado Cash governance was briefly seized via a malicious proposal that minted decisive voting power.

- Bundled proposals

Packaging many changes into one mega-proposal (or calling a vote a “ratification” after actions have already been taken) undermines legitimacy. Arbitrum’s AIP-1 backlash in 2023 over a large foundation allocation framed as ratification shows how process optics can melt trust even when a project backtracks.

- Multisig bottlenecks.

When off-chain votes depend on a small signer set to execute, execution can stall or introduce centralized bottlenecks. Optimistic execution plugins such as oSnap or Cosmos xgov SDK, as well as having clear signer policies, are proven solutions, but they’re not universal yet.

- Latency vs. market speed.

Economic Parameters that track market conditions (fees, risk caps, incentives) often sit behind week-long debates, leading to operational inefficiencies. Swing too far the other way—enabling instant execution with no delay, and you open the door to rushed or malicious changes, such as flash-loaned voting power.

The best practice here is to keep a default timelock for safety, but encode a narrow pre-bounded authority, such as pre-authorized stewards who can who can make small, auditable adjustments within strict on-chain limits.

- Identity is still hard.

Reputation, quadratic voting, and personhood systems promise fairer outcomes; recent research in 2024–2025 flags gaming risk, complexity, and UX overhead. Even credible tools (e.g., Passport-style attestations) add friction that can depress turnout or exclude good-faith newcomers.

How Governance Impacts Token Buyers

Governance doesn’t set price directly, but it shapes the three forces that do: supply, cash flows, and perceived risk. Recent empirical research has linked on-chain design choices to funding and valuation outcomes. It shows that governance structure (on-chain vs. off-chain, delegation, execution) correlates with how markets price a token over time. Below are some of the impacts:

- Predictable supply and fee rules move markets and support durable demand. When governance codifies fee burns, algorithmic pricing, and issuance, it changes the float markets must absorb and reduces uncertainty for builders, and, by extension, buyers.

On Ethereum, for example, EIP-1559 burns the base fee each block, adding structural deflationary pressure when usage is high; Pocket Network mirrors this linkage post-Shannon by pricing work in Compute Units, burning POKT per relay, and publishing on-chain “mint = burn” governance notices so issuance stays aligned with measured demand.

- Cash-flow rights drive expectations. When governance redirects or unlocks protocol revenues, markets often reprice on proposals alone. For example, Uniswap’s recurring fee switch debates show how value-capture votes move sentiment even before implementation.

- Execution design in governance is a risk premium. Off-chain polls that depend on multisigs to “do it later” add delay and uncertainty that markets notice and affect buying conditions; DAOs that wire votes to trustless on-chain execution reduce that gap; Pocket closes this loop for protocol-level parameters via Cosmos on-chain governance and posts forum notices documenting the exact actions taken.

- Dilution, buybacks, and treasury policy show up in price. Governance can dilute holders through emissions or, conversely, decrease supply via burns/buybacks; Maker’s public updates around raising the DAI Savings Rate and treasury actions illustrate how these choices cascade into MKR/DAI dynamics, while Pocket’s governance transaction notices and economics threads clarify when and why supply changes under Shannon.

Final Thoughts: Where Governance Really Shows

Governance isn’t just about votes, it’s about whether a network can make smart decisions and follow through. The strongest protocols don’t rely on vibes or forum talk. They wire rules into the code, so fees, supply, and upgrades run on clear, trackable logic.

Pocket Network does this well. Its two-layer setup combines public debate with on-chain execution using Cosmos x/gov. Pricing, burns, minting, and rebates in an enforceable, transparent, and measurable way.

If you’re a builder or token buyer, that matters. Projects with codified rules and clear execution tend to carry less risk and more stability. The ones that don’t? Markets notice.

Ask yourself:

- Are the rules coded, or just talked about?

- Does execution happen on-chain, or rely on someone pushing a button later?

- Can anyone participate under fair conditions, or is access quietly gated?