On May 16, 2024, the crypto meme world was jolted when a Solana-based meme coin platform, Pump.fun, was compromised by hackers who manipulated its bonding curve contracts. The exploit resulted in abrupt price swings and heavy losses—underscoring how powerful yet precarious these automated pricing mechanisms can be.

Despite the exploit, bonding curves remain a foundational element of DeFi, enabling tokens to be traded smoothly without relying on centralized intermediaries. These mathematical models are also vital for automated market makers (AMMs), powering seamless exchanges without using traditional order-book systems.

When executed securely, bonding curves offer real-time price discovery, liquidity, and fair market access. Projects like Pocket Network demonstrate their practical value by handling massive transaction volumes—almost one trillion relays daily—while adjusting token pricing in sync with user demand.

In this blog, we’ll unpack the core principles behind bonding curves, explore how they shape DeFi ecosystems, and examine real-world implementations—including how Pocket Network leverages them. We’ll also discuss key benefits, potential pitfalls, and best practices for ensuring these self-regulating models serve as a reliable foundation for decentralized networks.

What Are Bonding Curves?

Bonding curves are on-chain mechanisms that tie a token’s price directly to its supply. Think of them as automated pricing systems living on a smart contract: whenever someone buys new tokens, the supply goes up, and the price gradually increases. Conversely, selling tokens lowers the supply and, in turn, reduces the price. This creates an ongoing, transparent cycle of price discovery, all governed by the parameters set in the contract.

Practical Architecture and Mechanics

A typical bonding curve setup includes a smart contract, a reserve pool, and a predefined formula. Here’s a simplified scenario:

- Smart Contract: Manages the curve logic. It stores and updates token supply data, calculates the current price, and mints or burns tokens accordingly.

- Reserve Pool: Holds collateral (like ETH or another stable asset) that backs the token’s value. When buyers purchase tokens, the payment goes into this reserve; when they sell, they’re paid out from it.

- Predefined Curve (Formula): Often a polynomial or exponential function that decides how sharply the price changes with supply shifts.

Imagine you’re launching a new token for a grassroots environmental project (don’t mind the example). Instead of a traditional crowdfunding method, you implement a bonding curve or use a platform that offers such services. Early supporters buy at a low cost, and as more people join, the price increases.

The project can access the locked-up collateral to fund cleanups while participants benefit from increasing token value if demand grows. If demand dips (say, during an off-season or after a campaign ends), selling tokens automatically adjusts the price downward in a predictable manner—no centralized intermediary required.

A linear bonding curve.

Types of Bonding Curves

Bonding curves aren’t one-size-fits-all. Different formulas shape how a token’s price responds to changes in supply. Below are a few common types, along with real-world examples:

1. Linear: Uses a straightforward bonding curve in which price increases at a steady rate as more tokens are bought.

- Pros: Simple to understand; makes it easier to predict price movements.

- Cons: May not respond fast enough to sudden demand spikes, risking imbalance.

- Example: Early versions of Zora used a linear approach for some NFT pricing, rewarding early participation with predictable increments.

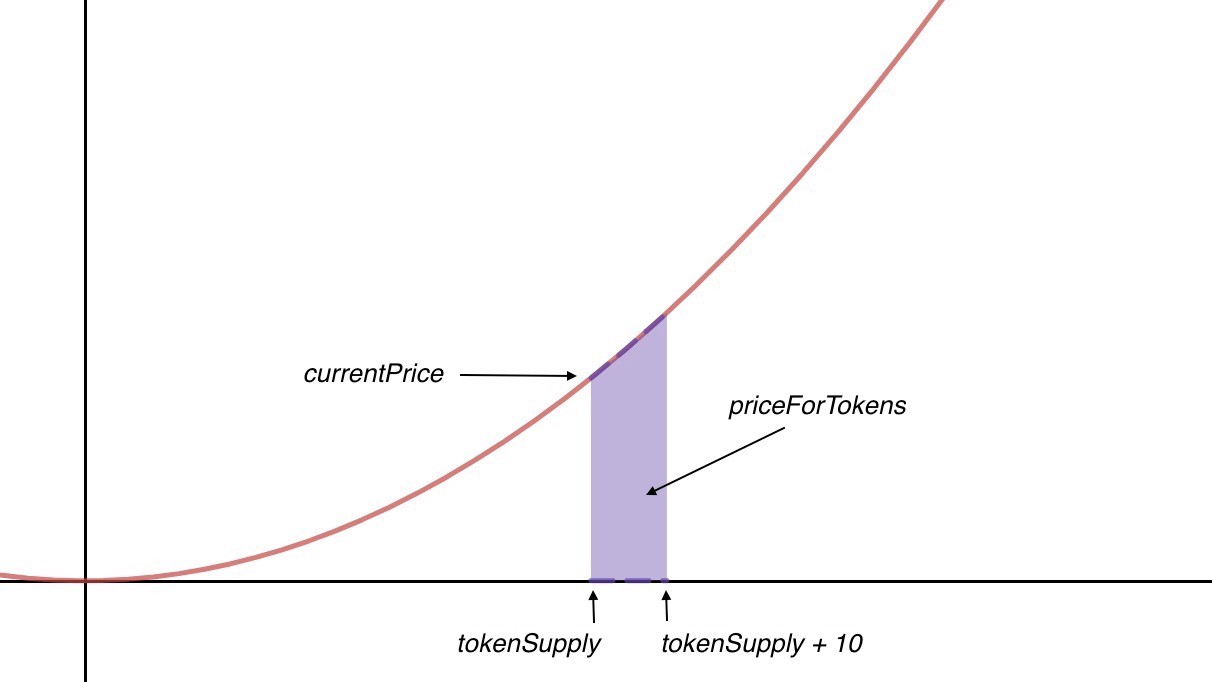

2. Exponential: The Price jumps more sharply with each additional token bought, reflecting exponential growth. The underlying formula ensures price sensitivity scales with usage.

- Pros: Quickly throttles excessive demand, helping prevent oversupply.

- Cons: If demand surges too rapidly, prices can become prohibitively high, discouraging new entrants.

- Example: Bancor pioneered the exponential model through its BNT token, raising prices significantly as demand grows.

3. Polynomial: Uses more complex formulas (e.g., quadratic or cubic) to set prices. The polynomial shape enables more strategic control over fundraising and token issuance over time.

- Pros: Allows for nuanced control over how quickly the price ramps up.

- Cons: Harder to model and predict, requiring careful simulations and parameter tuning.

- Example: The Commons Stack leverages “Augmented Bonding Curves,” a polynomial-based approach that channels part of the reserve into community funding.

4. Tiered: Divides the supply into intervals, each with its own pricing curve or set of rules. Some IDO (Initial DEX Offering) platforms split token sales into rounds or “tiers,” each with its own curve. Early rounds might have a gentler price slope to reward initial participation, while later tiers impose steeper price increases as the supply grows.

- Pros: It offers structured price stages, which are helpful for planned fundraising rounds.

- Cons: Less fluid than a purely continuous curve; may cause sudden jumps at tier boundaries.

- Example: Polkastarter and Balancer’s Liquidity Bootstrapping Pools use phased or tiered sale methods that mimic tiered bonding curves for smoother fundraising.

Bonding Curves as Dynamic Pricing Tools

In decentralized systems, bonding curves function as continuous price mechanisms, linking a token’s supply directly to its cost. When new tokens are minted, the price moves higher along a predefined curve; when tokens are burned, the supply contracts and the price naturally dip.

By automating these shifts via smart contracts, bonding curves eliminate the need for traditional order books, offering near-instant liquidity and a more transparent price discovery process.

Token Supply and Pricing Mechanics

At the heart of every bonding curve is a mathematical formula that sets the price based on supply. Core parameters—such as base price (where the curve begins), slope (the rate of price change), and collateral ratio (the level of reserve backing)—determine how aggressively price fluctuates.

- Minting Tokens: Buying tokens adds to the circulating supply, pushing the price up according to the curve’s slope.

- Burning Tokens: Selling reduces the supply, lowering the price in step with the same function.

For instance, when demand for Pocket Network’s services rises, token minting drives prices upward, attracting more node operators to handle increased network usage. Conversely, a drop in relays leads to token burning, easing the price back down without abrupt shocks.

Price Discovery in Action

Because all trades happen directly within the smart contract, there’s always someone to “buy” or “sell”—the contract itself. This removes the bottlenecks of order book systems and ensures continuous liquidity. The price at any moment is calculable and transparent, so users know upfront what it will cost to join—or exit—any given network.

For instance, when network demand spikes, the bonding curve raises prices to:

- Reduce overuse during peak times.

- Encourage more resources to be added to the network.

- Dynamically balance supply and demand.

During periods of high activity, the curve adjusts prices gradually, avoiding sudden spikes and keeping the system stable.

Market Dynamics

Although bonding curves create smooth, automated pricing, overall demand still tends to move through phases:

| Stage Level | Price Behavior | Market Impact |

| Early Stage (0–33% Supply) | Gentle slope, moderate price rises | Attract early participants |

| Growth Phase (34–66% Supply) | Steeper curve, faster price growth | Balances expansion and stability |

| Mature Phace (67–100% Supply) | Sharp curve, high price sensitivity | Limits excessive token creation |

This self-correcting structure lets developers fine-tune how quickly a token economy expands. They can encourage steady participation without triggering extreme price hikes or crashes by adjusting the curve’s parameters. The end result is a more resilient, user-friendly market mechanism—ideal for projects that aim to match real-world demand with on-chain resources in real time.

Common Uses of Bonding Curves

Token Sales and Funding

Bonding curves have reshaped how token sales work by introducing flexible and dynamic pricing. Instead of sticking to fixed prices, they allow prices to increase as more tokens are purchased. This approach rewards early participants while helping maintain stability over time.

Data Infrastructure Management

In decentralized data systems, bonding curves are used to allocate resources effectively and ensure service reliability. Dynamic pricing also helps prevent congestion and overuse.

A great example is Pocket Network, which handled nearly 1 trillion relays. Using its POKT token, Pocket Network coordinates global infrastructure access to deliver consistent and reliable data.

As data needs grow, bonding curves help:

- Encourage the deployment of additional infrastructure.

- Distribute network activity among providers efficiently.

- Ensure consistent service quality, even during peak times.

- Support long-term network scalability.

Examples of Categories of Platforms That Use Bonding Curves

- Automated Market Makers (AMMs)

Example: Protocols like Uniswap or Balancer.

How They Use Curves: AMMs rely on bonding curves (usually in the form of constant product or constant sum formulas) to set token exchange rates, ensuring continuous liquidity without centralized order books. - Token Launch and Crowdfunding Platforms

Example: Aragon Fundraising (early prototypes).

How They Use Curves: Projects can create bonding curve–based sales to automatically adjust token prices throughout their fundraising process, offering transparent pricing to participants and eliminating the need for manual price-setting. - Community Governance and Funding DAOs

Example: CommonStack.

How They Use Curves: Bonding curves provide a structured way to fund communal projects. Tokens are minted and burned in response to member contributions, aligning price dynamics with real community engagement. - Decentralized Data Infrastructure

Example: Pocket Network.

How They Use Curves: Bonding curves help scale node participation and usage costs in real-time. As demand for data relays grows, token prices adjust to incentivize more nodes; when demand cools, the system reduces cost pressures. - NFT Projects

Example: Certain NFT collections (e.g., using bonding curves for dynamic mint pricing).

How They Use Curves: Some creators apply bonding curves to price new mints or expansions of their collection, rewarding early buyers while limiting sudden price spikes and bolstering secondary market liquidity.

Benefits and Limitations of Bonding Curves

Here’s a breakdown of the main advantages and challenges of using bonding curves in decentralized networks.

Key Benefits

- Automatic Price Discovery: Bonding curves adjust prices dynamically based on supply and demand, reducing the risk of market manipulation and ensuring a fairer valuation of tokens.

- Continuous Liquidity: Since tokens can be bought or sold directly from the smart contract, projects aren’t reliant on external market makers. This simplifies trading and offers a more seamless user experience.

- Predictable Behavior: By following transparent mathematical formulas, bonding curves let participants understand how the price will change under different conditions. This clarity helps stakeholders make more confident decisions.

- Incentives for Early Adoption: As supply starts low, early participants buy in at reduced prices. This dynamic often spurs initial user engagement, driving network growth and encouraging long-term commitment.

- Efficient Resource Use: Dynamic pricing aligns resource consumption with user demand. By adjusting costs when demand rises or falls, the network can optimize its infrastructure and avoid sudden strain.

Main Limitations

- Technical Complexity: Writing and auditing bonding curve contracts can be intricate. Thorough testing, code reviews, and formal verification are vital to prevent costly bugs or exploits.

- Parameter Sensitivity: If key metrics like slope or reserve ratios are poorly chosen, price dynamics can become unstable. Robust modeling and simulations before deployment help fine-tune these parameters.

- Market Volatility: Rapid demand shifts can cause abrupt price fluctuations. Mechanisms such as spread capping or gradual rebalancing can help dampen these swings.

- High Gas Costs: On-chain transactions can be expensive, especially during network congestion. Adopting Layer 2 solutions and optimizing contract interactions can make bonding curves more cost-effective.

- User Accessibility

Because bonding curves involve unfamiliar concepts, non-technical users may find them intimidating. Clear educational materials and intuitive interfaces are critical for broader adoption.

Setting Up Bonding Curves

Technical Setup Guide

To implement bonding curves effectively, you need to set up several technical components and define key parameters. Here’s a breakdown of the main elements involved:

| Component | Purpose | Key Considerations |

| Smart Contract Architecture | Handles pricing logic and transactions | Must undergo thorough audits and testing |

| Curve Parameters | Governs how prices respond to demand | Requires careful economic modeling and simulations |

| Token Interface | Manages minting and burning of tokens | Should comply with ERC-20 standards (for Ethereum) for compatibility |

| Price Oracle | Supplies external pricing data | Needs redundancy to ensure reliability |

| Security Controls | Protects against potential exploits | Should include features like circuit breakers and transaction caps |

These elements ensure that the system operates securely and efficiently, laying the groundwork for practical applications.

Pocket Network’s Multisig Infrastructure

Pocket Network leverages multi-signature (multisig) mechanisms as a core part of its security and governance strategy. Rather than relying on a single key to authorize sensitive operations, multisig setups distribute control across several stakeholders, ensuring that no single actor can unilaterally make critical changes.

Key Areas Where Multisig Plays a Role in Pocket Network:

- DAO Treasury Management

The Pocket Foundation holds funds in multisig wallets, where multiple signatures are required to authorize fund transfers or spending. Proposals are split into three categories: PEPs (Pocket Ecosystem Proposals), PIPs (Pocket Improvement Proposals), and PUPs (Parameter Update Proposals), which cover decisions around DAO’s strategy, resource allocation, and funding decisions.

This setup reduces the risk associated with a single point of failure and enhances trust among community members.

- Contract Deployments and Upgrades

Critical actions such as deploying new code or upgrading existing smart contracts are gated by multisig approval. This ensures that changes affecting the network’s core functionality are vetted by multiple designated signers before execution. You can read more about governance proposals like PIP-38: Re-electing Michael O’Rourke to the Foundation on the Pocket Network Forum.

- Bridging and Cross-Chain Operations

For initiatives like the wPOKT bridge, multisig controls manage key functions such as minting and burning wrapped tokens. By requiring multiple trusted parties to sign off on transactions, Pocket Network secures its inter-chain transfers and helps maintain asset parity. More information on bridging can be found in the POKT Bridge documentation.

These measures enable Pocket Network to protect its funds, maintain operational stability, and uphold its decentralized ethos—all crucial for scaling a global network of data relays.

Conclusion

Bonding curves stand at the intersection of mathematics and market dynamics, offering a transformative approach to token valuation and liquidity in decentralized finance. By embedding price discovery directly into token supply mechanisms, they not only streamline transactions but also democratize access to emerging digital economies.

Final Thoughts

As we navigate this evolving landscape, it’s crucial to recognize the power and responsibility inherent in these mechanisms. While bonding curves can drive innovation and inclusivity, their design demands meticulous attention to detail and a deep understanding of economic principles to mitigate potential pitfalls.

For those intrigued by the potential of bonding curves, whether you’re a developer aiming to integrate them into your project, an investor seeking to understand their implications, or simply a curious mind eager to grasp the nuances of DeFi, the journey is both challenging and rewarding. Engage with the community, delve into the intricacies, and contribute to shaping a financial future that is more open, efficient, and equitable.