Security remains a top priority in cryptocurrency transactions, especially as the industry faces rising threats from cyberattacks and private key compromises. One of the most effective safeguards is multi-signature (multisig) authorization, a mechanism that requires multiple approvals to validate transactions, reducing reliance on a single point of failure.

Despite its security benefits, multisig is not foolproof—improper implementation can still lead to vulnerabilities. A recent example is the Bybit hack in January 2025, where attackers exploited weaknesses in the exchange’s multisig cold wallet system to steal $1.5 billion, making it one of the largest crypto heists in history. This breach highlights the need for robust security measures beyond just multisig itself.

This blog will explore how multisig authorization works, why it’s crucial for securing crypto assets, and best practices for implementing it effectively. Many organizations, including Pocket Network, leverage multisig wallets to manage key infrastructure securely, ensuring decentralized control over critical assets.

What is Multi-Signature (Multisig)?

At its core, a multisig authorization is a security mechanism that requires multiple private key approvals before executing a transaction. Unlike traditional single-signature wallets, where one key controls everything, multisig distributes control across various parties, reducing single points of failure. In literal terms, it presents as adding one or more friends/colleagues to final signoff on ongoing payments.

Watch the video below to understand Multisigs fully:Multisignature Wallets Explained | Animation | Cryptomatics

Exploring the M-of-N Model in Multisig

Multisig operates on an M-of-N model, where:

- N represents the total number of private keys that can sign.

- M is the minimum number of keys required to approve a transaction.

For example, a 2-of-3 multisig wallet means three private keys exist, but any two must sign for a transaction to be executed. This flexibility allows for stronger security models, such as:

- 3-of-5 setups for DAOs, ensuring a single entity doesn’t dictate governance decisions.

- 2-of-3 for institutional accounts, preventing a rogue employee from draining funds.

- 1-of-2 for inheritance planning, where a legal representative can hold a backup key.

How Transactions Work in a Multisig Setup

- Transaction Creation – A participant initiates a transaction and signs it with their private key.

- Approval Process – Other authorized signers review the transaction and add their signatures.

- Consensus Check – Once the required M signatures are collected, the transaction is broadcasted.

- Execution – The network validates the signatures and finalizes the transaction.

Under the hood, multisig wallets enforce these rules using cryptographic threshold signatures or smart contracts (depending on the blockchain). Bitcoin uses P2SH (Pay-to-Script-Hash) for multisig transactions, while Ethereum relies on smart contract-based wallets like Gnosis Safe.

The Benefits of Multi-Signature: Beyond Just Security

Multisig is not just about security but also about control, governance, and redundancy. Whether protecting exchange reserves, managing DAO treasuries, or securing institutional funds, multisig adds a critical layer of trust and risk mitigation.

While security is the most apparent advantage of multisig, its true power lies in how it reshapes control, accountability, and operational resilience within an organization or financial structure. Its benefits include:

a. Distributed Authority, Reduced Trust Assumptions

Traditional crypto wallets give complete control to a single keyholder, a model that has led to catastrophic losses due to hacks, internal fraud, or lost keys. Multisig removes this single point of failure by requiring multiple parties to sign off on transactions, enforcing collective decision-making rather than blind trust in one individual or system.

b. Governance That Scales With Complexity

In DAOs, institutional funds, and exchanges, financial governance isn’t just about security—it’s about ensuring transactions align with strategic intent. Multisig enables precise delegation, where specific signers hold different levels of control based on role, reducing the risk of unilateral or rogue actions.

c. Operational Redundancy Without Compromising Security

Losing a private key in a single-signature setup can mean irreversible asset loss. With multisig, structured key distribution allows for redundancy without lowering security thresholds—if one key is lost, others can still facilitate recovery, mitigating risks from technical failures and human error.

d. Mitigating Insider Threats and Collusion Risks

Many high-profile crypto exchange failures stem from insider misconduct or compromised credentials. Multisig introduces a built-in safeguard against internal fraud, as no single actor can unilaterally drain funds or alter transaction permissions.

e. Programmable Risk Management

When paired with smart contracts, multisig can enforce predefined conditions for fund movements—such as requiring specific signers for different types of transactions or introducing time-lock mechanisms for added security. This reduces reliance on manual oversight while protecting assets against rushed or unauthorized withdrawals.

However, as seen with other exploits related to multisigs in the past, poor multisig implementation can lead to significant vulnerabilities. Proper key management, signer distribution, and periodic audits are essential to ensure that multisig does what it’s meant to—protect assets, not create new attack surfaces.

Multi-Signature System Mechanics

Multisig is widely used to manage business funds, govern DAOs, and secure smart contracts. Platforms like Gnosis Safe, BitGo, and Casa enable organizations to set up secure multisig wallets. Proper planning, key management, and regular updates ensure a robust system for protecting digital assets.

Basic Components

To set up a secure Multisig system, it’s essential to understand its key parts:

- Private Keys: These are cryptographic keys used to sign transactions. Each participant has their keys, which should be stored securely and separately.

- Public Address: This is the address tied to the multisig system. It specifies how many signatures (M) are needed from the total participants (N) to authorize a transaction.

- Smart Contract: Smart contracts enforce the rules of the multisig system, ensuring the required number of valid signatures are collected from authorized participants.

Signature Verification in Multisignature Systems

At the heart of every multisignature (multisig) system is the signature verification process—the mechanism that ensures only authorized signers can approve transactions. This process is more than just checking whether a signature exists; it involves cryptographic validation, smart contract enforcement, and transaction state tracking. Here’s how it works:

a. Transaction Initialization

- A participant (signer) initiates a transaction by creating a message that specifies transaction details (e.g., recipient address, amount, gas fees).

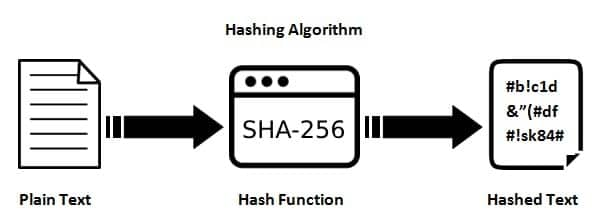

- This message is hashed (e.g., using SHA-256 or Keccak-256 in Ethereum) to create a unique fingerprint.

SHA-256 encoding. Source: Encryption Consulting

b. Signature Generation

- The participant uses their private key to sign the hashed transaction using a cryptographic scheme like ECDSA (Elliptic Curve Digital Signature Algorithm) or EdDSA (Edwards-curve Digital Signature Algorithm)

- The resulting digital signature is composed of two main components:

- r (randomized component): Helps prevent signature reuse.

- s (signature proof): Represents the actual signed data using the private key.

c. Signature Submission & Aggregation

- The signed message is broadcast to the multisig smart contract, which keeps track of incoming signatures.

- Each signature is paired with its corresponding public key, allowing the contract to verify if the signer is an authorized participant.

d. Threshold Enforcement (M-of-N Validation)

- The contract checks if at least M valid signatures are collected from N possible signers.

- Once the threshold is met, the transaction proceeds to execution. If not, the transaction remains pending.

Single vs. Multi-Signature: Key Differences

Single and multi-signature systems differ in more ways than just the number of required approvals. Here’s a side-by-side comparison:

| Feature | Single-Signature | Multi-Signature |

| Authorization Requirements | One private key | Multiple private keys (M-of-N) |

| Security Level | Vulnerable to a single point of failure | Security spread across multiple participants |

| Recovery Options | Relies on backups | Recovery possible through other signers |

| Transaction Speed | Instant approval possible | Requires coordination between signers |

| Cost Structure | Lower fees | Higher fees due to added complexity |

| Risk Distribution | Centralized risk | Risk spread among participants |

Although multisig systems involve more coordination, they provide stronger security by distributing authorization. For practical use, focus on proper key management, set realistic signature thresholds, and clearly define backup and recovery plans.

Setting Up Multi-Signature Systems

Let’s dive into configuring your multisig setup for security and ease of use.

Selecting Signature Requirements

Decide on the number of signatures needed to approve transactions. A typical setup is 2-of-3, which ensures security while allowing flexibility.

For larger organizations, consider these factors:

- Number of participants: More people involved means stronger security but adds complexity.

- Transaction frequency: Frequent transactions may benefit from fewer required signatures for speed.

- Risk level: High-value transactions might need more signatures for added protection.

- Geographic distribution: Account for time zones when coordinating approvals from multiple signers.

Multi-Signature Wallet Setup

Here’s how to set up a secure multisig wallet:

1. Choose a Platform

Pick a trusted platform that supports multi-signature wallets. Popular options include:

- Gnosis Safe: This offers customizable signature requirements and strong security for enterprises.

- BitGo: Provides advanced security tailored for institutional use.

- Casa: Designed for individuals and small businesses needing multi-signature solutions.

2. Configure Authorization Parameters

Set up your M-of-N structure based on your needs. For example:

- 2/3 works well for small teams.

- 3/5 is suited for medium-sized organizations.

- 4/7 is ideal for larger setups.

See above for other considerations for M-of-N setups.

3. Set Up Recovery Options

Plan for emergencies by:

- Assigning backup signers.

- Documenting recovery protocols.

- Storing recovery data in a secure location.

4. Perform a Test Transaction

Before fully relying on your multisig wallet, perform a small-value test transaction. This confirms that all signers understand the process, that keys are correctly configured, and that authorization parameters behave as expected.

5. Document Roles and Procedures

Clearly document signer roles, permissions, and transaction protocols. Keep this documentation secure but accessible to relevant stakeholders, streamlining decision-making and audit processes.

Security and Management Guidelines

Key Storage Methods

Protecting your keys requires a mix of both digital and physical security measures. Thanks to their built-in security features and encrypted storage, hardware wallets are a reliable option for safeguarding active keys. For organizations, consider these practices:

- Use encrypted portable storage for backups when necessary.

- Employ air-gapped systems for critical key-related tasks.

- Store backup keys in separate, secure physical locations.

Pair these methods with well-planned backup and recovery strategies to ensure your keys remain safe.

Backup and Recovery Steps

An effective backup and recovery system ensures your multisig wallet remains resilient, secure, and accessible—even in worst-case scenarios. Your backup plan should comprehensively address primary recovery protocols and emergency scenarios, ensuring uninterrupted access without sacrificing security.

In practice, this involves securely distributing encrypted key backups across multiple locations. Methods like Shamir’s Secret Sharing, used by solutions like Casa, split backup data, ensuring no single party holds the entire key.

Regularly testing recovery procedures (ideally every three months) confirms readiness and highlights potential gaps early. Crypto exchanges routinely conduct mock recoveries to validate protocols.

For emergency access, trusted contacts or successors should have clearly documented roles and controlled rights. Platforms like Casa Covenant facilitate inheritance planning, enabling smooth, authorized transfers. Additionally, services such as Gnosis Safe incorporate time-delayed recovery options, preventing rapid unauthorized access and giving rightful owners time to respond.

Key Update Schedule

Regularly updating your keys is a crucial part of maintaining security over time. Follow a structured update schedule like the one below:

| Update Type | Frequency | Action Items |

| Regular Rotation | Every 6 months | Rotate keys and transfer assets. |

| Emergency Updates | As needed | Replace keys immediately after a compromise. |

| Access Review | Quarterly | Audit permissions and update authorized users. |

| Recovery Testing | Every 6 months | Test backup functionality and recovery steps. |

To further strengthen security:

- Plan key rotations during periods of low activity.

- Use version control and logging to track changes.

- Regularly review and update the list of authorized signers.

- Keep detailed documentation to meet compliance requirements.

Common Uses of Multi-Signature Systems

Multisig systems have practical, widespread applications in managing assets, governance, and critical operational processes:

Business Fund Management

Companies commonly use multisig wallets like BitGo and Fireblocks to manage corporate treasuries securely. A typical 3-of-5 multisig setup might involve distributing keys between a finance manager, compliance officer, and executive leadership. These platforms support tiered permissions, large transaction thresholds, and detailed audit trails for enhanced operational oversight.

DAO Operations

Decentralized Autonomous Organizations (DAOs) such as MakerDAO and Compound rely on multisig infrastructures to manage treasury operations and governance mechanisms. By requiring multiple signers to approve transactions or proposals, these DAOs ensure decentralized decision-making. Integrating on-chain voting, time locks, and public action logs reinforce transparency and protect community-owned assets.

Smart Contract Management

Multisig wallets also play a crucial role in managing smart contracts. Platforms like OpenZeppelin Defender allow teams to implement multisig approvals for sensitive contract operations—such as protocol upgrades, role assignments, or parameter tuning. This layered approval process safeguards code integrity and reduces the risk of accidental or malicious changes.

Pocket Network’s Commitment to Multi-Signature Security

Pocket Network exemplifies a rigorous approach to multi-signature (multisig) security within its decentralized architecture, ensuring robust governance and operational integrity.

Infrastructure Synergy

Pocket Network operates a vast network of nodes designed to provide decentralized access to blockchain data. This decentralized approach mitigates single points of failure, ensuring continuous availability—a critical feature for multisig operations that demand high reliability. By integrating with Pocket Network, multisig systems benefit from a resilient backend capable of handling substantial transaction volumes without compromising performance.

wPOKT Bridge: A Case Study in Multisig Implementation

A notable example of Pocket Network’s integration with multisig systems is the development of the wPOKT bridge. This bridge facilitates wrapping POKT tokens to wPOKT on the Ethereum blockchain, enabling broader utility and interoperability. To secure this process of wrap bridge, a Gnosis Safe 5-of-7 multisig wallet was established, comprising trusted community members and foundation representatives.

This configuration ensures that no single entity has unilateral control over minting and burning wPOKT tokens, enhancing security and fostering community trust.

Smart Contract Governance

In the wPOKT implementation, the DEFAULT_ADMIN_ROLE is assigned to a secure multisig wallet. This wallet includes signers from the Pocket Foundation and the broader community, ensuring decentralized governance over critical contract functions. Such a setup exemplifies Pocket Network’s commitment to collaborative oversight and the prevention of centralized control in decentralized applications.

Conclusion

Multi-signature authorization is one of the most effective tools in ensuring blockchain systems’ security, governance, and operational resilience. By requiring multiple private keys to authorize transactions, multisig reduces the risks associated with single points of failure, fraud, and insider threats. Whether securing institutional funds, managing DAO treasuries, or overseeing smart contracts, multisig is critical in building trust and accountability within decentralized ecosystems.

As demonstrated by real-world implementations like the wPOKT bridge within Pocket Network and the ongoing development of Gnosis Safe in DAOs, multisig enables collective decision-making and transparent governance. However, its success hinges on proper key management, signer distribution, and continuous audits. Without these practices in place, multisig setups can still be vulnerable.