In summary:

- This blog explores how Shannon transforms $POKT into a utility-driven, deflationary asset.

- We cover the shift to burn mechanics and Compute Unit pricing, new utility for open data services, reduced relay costs, Cosmos SDK migration, and renewed DAO governance.

- Together, these changes position $POKT as a real economic instrument powering Pocket Network’s open data economy.

Introduction: Shannon Is Coming — And It Changes Everything

Since its inception in 2020, Pocket Network has quietly built one of the most used decentralized infrastructure protocols in Web3. At its core, it enables applications to access blockchain data via a global network of decentralized node operators. The reward mechanism? $POKT.

But with the arrival of the Shannon upgrade, $POKT is being fundamentally transformed. No longer just a reward token or inflationary incentive, it’s now evolving into a utility-driven, deflationary asset at the center of Pocket’s open data economy. This blog post explores that transformation’s architecture, rationale, and implications.

This post is part of a broader Shannon upgrade announcement series. Here, we focus specifically on tokenomics — what’s changing, why it matters, and what it means for token holders, app developers, and infrastructure builders.

This post explores how Shannon transforms $POKT and what it means for Pocket’s future in decentralized infrastructure — from blockchain data to AI and beyond.

Lessons from the Past: How the POKT Token Worked to Date

Initially, POKT was created as an incentive mechanism to reward infrastructure operators. Pocket aimed to replace centralized API services (like Infura and Alchemy) with decentralized node operators who served blockchain data to applications. To encourage participation, node operators were paid in newly minted POKT tokens for each relay served.

Applications accessed the network by staking POKT, effectively pre-paying for usage. But there was a catch: once staked, usage didn’t deplete or consume the token. There was no direct relationship between demand and cost.

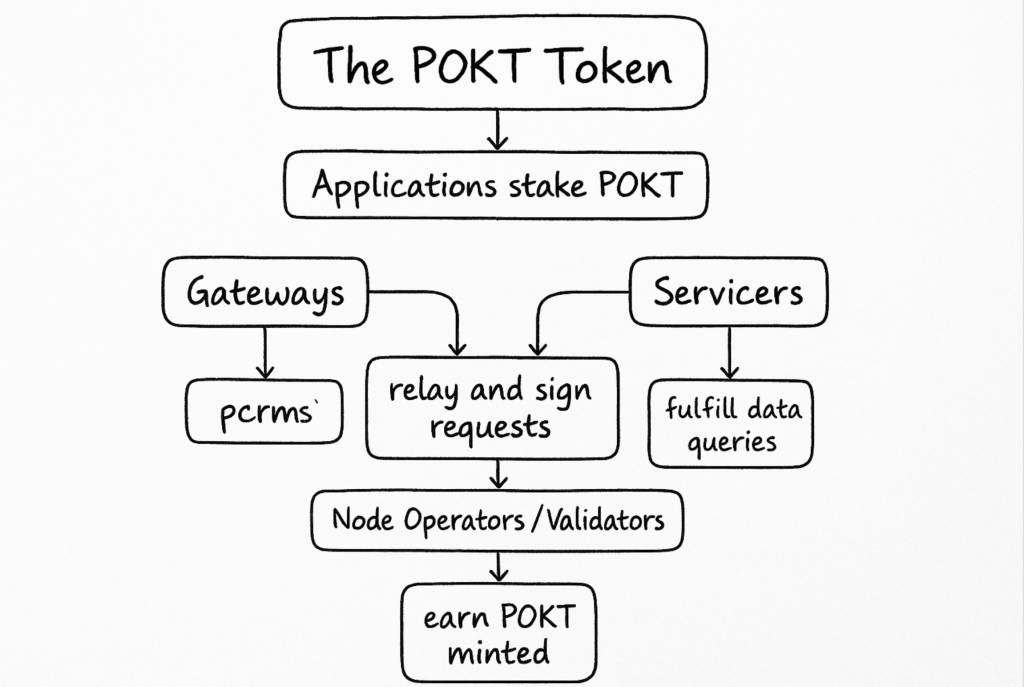

The tokenomics reflected this purpose:

- Applications stake $POKT to gain access to bandwidth for querying data, essentially renting access via staking.

- Gateways stake $POKT to relay and sign requests on behalf of applications.

- Servicers stake $POKT to fulfill data queries and earn rewards.

- Node operators/Validators stake to help secure consensus and earn $POKT for each validated relay.

How $POKT is used in the old model – Pre-Shannon

While this model helped the network scale, it lacked economic discipline. There was no direct link between usage and cost, and inflation continued unchecked.

Table 1: Pre-Shannon $POKT Tokenomics Overview

| Feature | Pre-Shannon Design |

| Monetary policy | Fully inflationary |

| Token supply sink | None |

| Utility surface area | Staking for RPC use or node participation |

| Governance | Dormant/manual interventions only |

| Incentive alignment | Supply-side focused |

Shortcomings of the Original Model

- Unlimited Inflation: The token supply increased continuously regardless of demand or usage volume.

- No Burn Mechanism: Tokens were only minted, never destroyed—creating unchecked inflationary pressure.

- Static App Staking: Applications staked once for access, regardless of usage—no feedback loop between actual demand and cost.

- Token Price Decoupled from Usage: The volume of relays served didn’t impact POKT’s market price, leading to weak value capture.

- Governance Inertia: Economic parameters couldn’t adapt swiftly because community governance was minimal or inactive.

This model made sense for a bootstrap phase—incentivizing nodes and seeding liquidity—but it failed to provide the economic feedback loops required for long-term sustainability. Developers got a robust network, but holders saw inflation outpace demand.

Why the Shift Was Inevitable

Since its launch in 2020, Pocket Network has focused on decentralizing access to blockchain data — and by most technical measures, it succeeded.

- It has supported 60+ blockchain networks, including Ethereum, Polygon, Solana, Avalanche, and Base.

- Its decentralized node infrastructure has served over 868 billion relays to applications across the Web3 ecosystem.

- Thousands of Servicers operate worldwide, contributing to one of the most distributed RPC networks in production.

- Pocket’s architecture enables low-latency, geo-aware routing with redundancy at the protocol level — a design built for multi-chain scalability.

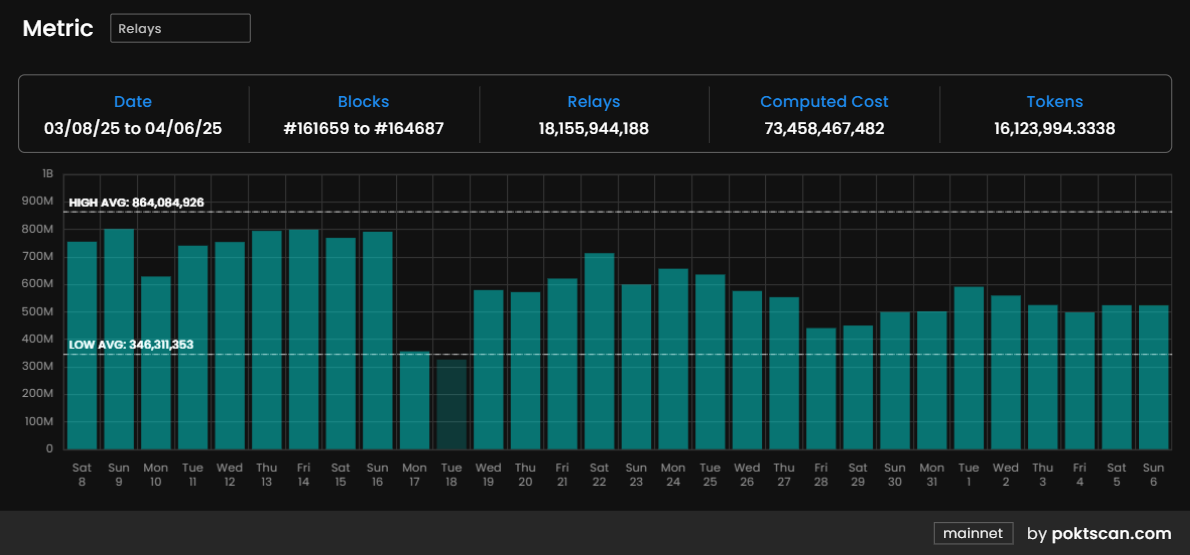

Relay Metrics from March 8th to April 6th, 2025. Source: POKTScan

But this success created new challenges: while relay volume grew, there was no mechanism to capture value or limit inflation. Applications accessed the network through static staking, consuming relays with no direct economic cost. Servicers were rewarded regardless of the utility or cost of those relays. Over time, inflation outpaced sustainable usage.

Meanwhile, demand was also evolving:

- Pocket now serves inference traffic for open-source LLMs like DeepSeek, making it viable for agentic workloads. The implementation was formalized in a peer-reviewed paper as a decentralized model for monetizing AI inference.

- Community proposals in the Pocket network’s Forum have outlined the potential for relaying decentralized social data, enabling censorship-resistant messaging and composable infrastructure for new communication protocols.

The New Design Goals for POKT

The pipes were there. But the tokenomics weren’t built to scale with them. The Shannon upgrade addresses this misalignment. It introduces the following for $POKT:

- Usage-based burn mechanics

- Deterministic pricing via Compute Units (CUs)

- DAO-controlled minting and rebates

- Expanded utility across data types

The Pocket Foundation and Economics Committee approached the Shannon upgrade with three guiding principles:

- Usage-Linked Supply: Mint tokens only when services are actually consumed.

- Deflationary Pressure: Introduce burn mechanics to reduce circulating supply during high demand.

- Open Data Utility: Expand $POKT’s use beyond blockchain RPC to support any data-intensive application.

These principles required a total rewrite of how the protocol thinks about cost, value, and rewards. They also needed a pricing model, programmable economics, and governance with teeth. Let’s go over each of them one after the other.

I. The Burn Mechanism: From Inflationary to Deflationary Pressure

Shannon introduces a burn-to-pay model. Applications and Gateways now pay for relays by burning POKT. This burn is automatic and on-chain, creating direct deflationary pressure.

Compute Units (CUs): The New Pricing Primitive

CUs are Pocket’s new internal currency for quantifying work. Each data request (a “relay”) has a CU cost, and applications pay for relays by burning POKT based on the CU pricing. CUs standardize the cost of relays based on work done. Rather than arbitrary per-chain rates, Shannon prices all data access around this new unit:

Here’s the breakdown:

- Each relay consumes Compute Units (CUs).

- 1 CU = $1 / 1,000,000,000 (i.e., 1 nanoUSD or $1 per billion CUs).

- The protocol adjusts the POKT/CU ratio via a parameter called CUTTM (Compute Unit to Token Multiplier).

- Initially, the CUTTM measures 1 CU = 495 picoPOKT (pPOKT), or 0.000000495 POKT per CU.

For every relay processed, a proportional amount of POKT is burned. This approach makes POKT a consumable asset—like gas in Ethereum.

How It Works: Step-by-Step

- A Gateway or app initiates a relay.

- The protocol calculates CU cost based on the data requested.

- The app burns the corresponding amount of POKT.

- Servicers and validators are reimbursed in newly minted POKT.

- Total mint = total burn (plus optional DAO reward %).

The DAO can mint slightly more for treasury growth, but only via governance-approved reimbursement events. There’s no minting faucet—only reimbursement from demand.

Why Is This Important?

- Reduces circulating supply over time.

- Incentivizes economic efficiency—only valuable relays are paid for.

- Creates price pressure if demand increases faster than minting (which is now tightly controlled).

Minting = Burning

No More Unchecked Inflation. Unless the DAO votes otherwise, new POKT can only be minted to match what is burned. This transforms the token from an inflationary reward tool to a market-priced utility asset.

Table 2: Old vs New Minting Model

| Model | Minting Model | Burn Mechanism | Supply Growth |

| Morse | Mint per relay | ❌ None | Inflationary |

| Shannon | Mint = Burn | ✅ Yes | Neutral |

This subtle but powerful change realigns incentives between demand and token supply. And yes—this is the most important update on Shannon.

The Impact on $POKT Supply

Shannon introduces a dynamic supply model where burn and mint are tightly coupled. If usage remains steady and burn outpaces mint, the token supply contracts. If usage increases and the token price rises, fewer tokens are required per relay, which will naturally dampen new issuance. It’s an elegant feedback loop that transforms $POKT into an actual utility token governed by real demand.

II. Expanded Utility: $POKT as the Currency of Open Data

Burning alone isn’t enough. For a token to be valuable, it must be used.

Pocket started as a decentralized RPC provider for blockchains. With Shannon, it’ll evolve into a general-purpose data protocol, serving not just blockchain requests but any open data.

The Shannon upgrade radically expands the use of $POKT. It introduces infrastructure that lets any data source plug into Pocket and start charging for access via token burn, typically enabling the service and monetization of any open data.

This is enabled through Grove’s PATH (Path API & Toolkit Harness) framework, which gateway framework lets anyone build Gateways and connect to the network. Through it, developers can now:

- Deploy open-source AI models (e.g., DeepSeek, Llama 3)

- Run their own Gateways.

- Connect to any REST/HTTP compatible API.

This opens up high-value use cases:

Table 3: Use Cases for Pocket Network new data models

| Use Case | Description |

| LLM Serving | Run open-source inference models as monetizable data sources |

| AI Agent Infrastructure | Provide decentralized access for bots and agents |

| Open Social Data Relays | Relay messages for protocols like Nostr |

| Web APIs | Serve any open REST or GraphQL endpoint as a data source through Pocket |

| DePIN Data Streams | Stream decentralized data from IoT devices, mapping tools, or telemetry sensors |

Each of these relays consumes CUs, which burn $POKT. The token will become the common currency of decentralized compute and data access.

This is the economic design Web3 infra protocols have been seeking. And Pocket is delivering it, thus expanding the addressable market from blockchain devs to:

- AI startups

- Data brokers

- Sensor networks

- Media feeds

- Knowledge interfaces

For example, Grove demonstrated how a locally run DeepSeek model can serve prompts over Pocket using PATH — with each interaction burning $POKT through Shannon’s CU pricing model.

III. Lower Relay Costs Through $POKT

The team also used Shannon as an opportunity to address a long-standing issue: pricing, which was one of Pocket’s biggest criticisms pre-Shannon

Pocket’s previous pricing of 14.3 USD per million relays made it uncompetitive as it was significantly more expensive than most RPC alternatives.

With Shannon:

- Average price per million relays: $2.50

- Volume rebates: up to 40% for high-traffic apps

- Token payments: Burned, not transferred

These changes position Pocket Network as a strong competitor in the infrastructure space, offering some of the lowest costs in the market while preserving complete decentralization and eliminating single points of failure. Below is a comparison table with some of the industry leaders in RPC infrastructure.

With this pricing model, even premium chains like Ethereum and Solana are more affordable to serve — without compromising decentralization or quality.

Table 4: Pocket vs Competitors

| Provider | Avg Cost (1M Relays) | Model |

| Infura | $6.58 – $12 | Subscription-based |

| QuickNode | $10+ | Tiered plans |

| Alchemy | $7 – $15 | Usage or subscription |

| $2.50 (avg) | Burn + Rebates |

IV. Architectural Upgrade: Shannon Moves $POKT to the Cosmos SDK

Shannon isn’t just a tokenomics update — it’s a full protocol re-architecture. At its core is Pocket Network’s migration to the Cosmos SDK.

This shift directly impacts $POKT, making it more adaptable, interoperable, and future-proof.

What This Means for $POKT

- IBC Compatibility

The new architecture lays the groundwork for Inter-Blockchain Communication (IBC), allowing $POKT to move across Cosmos chains and unlocking future use cases in liquidity, governance, and utility. - Modular Token Logic

Cosmos SDK enables features like DAO-governed upgrades, on-chain slashing, and dynamic staking — all without requiring protocol rewrites. $POKT becomes easier to evolve with the network. - Security and Reliability

Built on a battle-tested framework, the Cosmos SDK adds resilience to Pocket’s infrastructure and strengthens the foundation of the $POKT economy.

Where Things Stand Now

Pocket’s new Cosmos-based chain soft-launched in March 2025 and is already producing blocks — with over 4,000 confirmed in the first days. The team is onboarding key components — validators, new block explorers, exchange integrations — and preparing for future IBC support.

V. Introducing Rebates To Bootstrap Demand Sustainably

To support early adoption without printing more tokens, Shannon introduces rebate mechanics. Gateways processing large volumes of relays are eligible for rebates from the DAO treasury. These rebates are tiered based on volume, funded by the DAO, and capped at 128 trillion CUs per quarter.

How It Works

- Gateways must register and meet standards.

- Rebate % is determined by average daily traffic over the past 90 days.

- Rebate tiers range from 10% to 40%, depending on traffic volume..

Table 5: Rebate Tiers

| Average Daily CUs | Relays/day (approx) | Rebate % |

| < 250B | < 105M | 0% |

| 250B–1250B | 105M–525M | 10–40% |

| > 1250B | > 525M | 40% |

This helps to encourage onboarding of Gateways and competition between high-traffic apps while ensuring the DAO treasury isn’t drained unsustainably. It is part of a broader strategy to transition Pocket Network toward a more demand-driven economy, where growth is balanced with fiscal responsibility.

VI. Governance Returns — Quietly, But Decisively

Pocket was initially governed by a DAO but had paused community governance as the protocol matured. While a DAO technically existed, most decisions were made centrally. With Shannon, governance is coming back in a more refined and gradual form.

- The DAO now manages treasury minting (limited and controlled).

- Governance over CUTTM (pricing) allows adjustment to market conditions.

- Voting on incentive changes, gateway standards, rebate strategies, and roadmap updates resumes.

While the focus remains on protocol stability, Shannon lays the groundwork for community-driven control of the ecosystem.

Future posts will dive deeper into the revived governance framework. For now, token holders can be assured: governance is back on the roadmap.

VII. The Big Picture – $POKT as a Real Economic Instrument

After Shannon, $POKT is no longer just a reward token for node operators. It becomes a functional economic unit at the heart of a working market — a utility token with real consumption, pricing, and policy mechanics behind it.

$POKT now functions as a:

- Commodity consumed to access data

- Pricing mechanism for relays and services

- Governance weight tied to economic parameters

- Scarce asset with supply determined by usage

This transition positions $POKT among a small set of tokens in Web3 that operate in live economic systems, not just incentive loops. It’s no longer speculative by design — it’s burned with use, governed by market feedback, and priced against real-world demand.

For token holders, the implications are significant:

- Burn pressure scales with usage, creating long-term price support

- Inflation only occurs in response to actual demand (mint = burn)

- Governance connects directly to protocol levers like pricing and rebates

- A growing set of consumers — from LLMs to Gateways — now drive token velocity

If Pocket succeeds in powering the open data economy, $POKT becomes the utility layer — fueling access, governance, and sustainability.

Conclusion

Shannon didn’t just upgrade Pocket Network’s tokenomics — it reconnected $POKT to the network it powers.

The shift from unchecked inflation to burn-based pricing, from static staking to usage-linked economics, and from passive token holding to active utility has transformed $POKT into something rare in Web3: a token that operates within a working, usage-driven market.

$POKT now reflects the value of the network it powers. Every relay has a price. Every price is paid in $POKT. Every payment burns the token. This feedback loop ties protocol usage directly to supply and demand. $POKT moves as the network moves.

At the same time, Shannon broadens the scope of what Pocket can serve. Beyond blockchains, it now supports AI inference, open data APIs, decentralized social, and more — each one a new consumer of $POKT, and each one part of a broader open data economy.

What Comes Next

If you’re building within the Pocket ecosystem — or holding $POKT and watching its evolution, now is the time to take another look at what’s possible.

Start Here:

- Read the Shannon Protocol Economics

- Join the Pocket Network Forum

- Explore Gateway and data service tools like PATH.